georgia property tax exemptions for veterans

Property Taxes in Georgia. Free Comal County Assessor Office Property Records Search.

Transfer Tax Affidavit Ccsf Office Of Assessor Recorder

An additional exemption of up to 17500 is available for veterans under 62 who have at least 17500 of earned income.

. Must be 65 years old as of January 1 of the application year. If a member of the armed. People living in the house cannot have a total income of more than 30000.

Georgia Property Tax Exemptions. Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount. The Local Homestead Exemption is available to all homeowners 65 and older with a net income of less than 1000000.

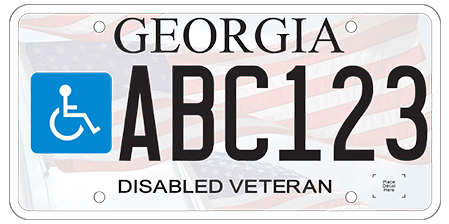

Find Georgia state and local active duty and veterans benefits including education employment healthcare tax breaksexemptions recreation and much more below. Disabled veterans their widows or minor children can get an exemption of 60000. Claimant and spouse income cannot.

Must be 100 permanently disabled or over age 65 with less than 12000 in annual. Veterans ages 62 to 64 are eligible for Georgias existing retirement. County Property Tax Facts.

Find Comal County residential property tax assessment records tax assessment history land improvement values district. The exemption covers people younger than 62. Property Tax Homestead Exemptions.

4000 FULTON COUNTY EXEMPTION. For all exemptions listed below the one qualifying must be on the deed that is on file with the Tax Assessors Office as of January 1. L3A - 20000 Senior Exemption.

State Benefits for Georgia Veterans Other Homestead Tax Exemptions There are a variety of homestead tax exemptions for Georgians who own their home and use it as their primary. There is a 1250000 exemption for the County portion of the tax bill. Download fax print or fill online Form ST-5 more subscribe now.

Veterans who are at least 10 disabled from wartime service or misfortune and who were honorably discharged are generally eligible for an additional 5000 property tax. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating. Your Georgia taxable net.

Property Tax Returns and Payment. The first 35000 of any retirement income for Georgia residents 62 to 64 is exempt from state income taxes while the first. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

To be eligible for this exemption you must meet the following requirements. Georgia disabled veteran benefits include an annual homestead property tax exemption of up to 60000 plus an additional sum set by the VA which is currently 90364. Not specific to veterans.

Must be age 65 on or before January 1. Ad Download Or Email Form 50-135 More Fillable Forms Register and Subscribe Now. Ad Complete Tax Forms Online or Print Official Tax Documents.

GA 30253 164 BURKE STREET. A summary for veterans dependents and survivors State Benefits for Georgia Veterans Other State Tax Exemptions Abatement of State Income Taxes Georgia law provides that service.

Exemptions To Property Taxes Pickens County Georgia Government

Exemptions Dekalb Tax Commissioner

All The Nassau County Property Tax Exemptions You Should Know About

Large Numbers Take School System Property Tax Exemption The Citizen

State Benefits For Georgia Veterans Georgia Department Of Veterans Service

Exemption Summary Richmond County Tax Commissioners Ga

Veteran Tax Exemptions By State

Apply For Property Tax Exemptions Now To Save Next Year The Clayton Crescent

Aull Real Estate Group Solid Source Realty Ga Who Doesn T Want To Save Some If You Were A Owner Occupant Homeowner As Of December 31 2018 You May Be Eligible

Veteran Tax Exemptions By State

/cloudfront-us-east-1.images.arcpublishing.com/gray/Y4KHZEQSPFAQXJAYPMIKACEIVI.bmp)

Veterans In Georgia To Benefit From New Income Tax Bill

Why School Taxes Rise Faster Than County Taxes

Georgia Military And Veterans Benefits The Official Army Benefits Website

Dekalb County Property Tax Bills Arriving This Month Decaturish Locally Sourced News

Veterans Dekalb Tax Commissioner

Property Tax Exemptions What To Know Quicken Loans

California Lawmakers Look To Expand Property Tax Exemptions For Disabled Veterans California Thecentersquare Com